Cheap Car Insurance in Douglasville, GA

We specialize in offering great coverage at awesome prices

Searching for top-notch auto insurance in Georgia can be trickier to navigate than dodging a raccoon crossing the road, although there are plenty of ways to obtain the perfect plan without breaking the bank. So, grab your sweet tea, take a seat on your favorite rocker, and let’s explore how to find the best deals.

Everything You Need to Know About Affordable Auto Insurance in Georgia

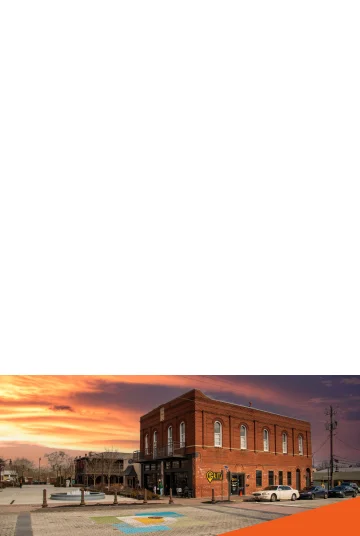

Nestled just west of Atlanta, Douglasville offers a blend of Southern charm and modern amenities to discover by car. You can take a scenic drive down Chapel Hill Road and pass historic landmarks like the Douglasville Cultural Arts Center and the Douglas County Courthouse, or head to Sweetwater Creek State Park for hiking, picnicking and birdwatching in the Georgia countryside.

As you check out these local sights, you’re going to need Georgia car insurance. The Peach State requires you to have suitable coverage when you’re driving, so whether you’re seeking liability coverage, full coverage plans, or discounts for safe driving habits, there are options available to help you save money on your auto policy.

How Much Does Car Insurance Cost in Douglasville, GA?

People in Douglasville pay approximately $73 per month for state-minimum required liability auto insurance, $5 more than the typical payment in Georgia of $68, and $11 more than the national mean of $62.

Full coverage auto insurance in Douglasville is about $160 per month, $58 less than Georgia’s average of $218 and $55 less than the nation’s, which is $215.

Ready to Get a Quick Quote?

Different Vehicle Options for Insurance in Douglasville, GA

There are a variety of types of auto protection in Douglas, like the three options below.

- Car Insurance is most commonly known for its varying levels of coverage. Make sure you work with your provider so they can help you get the solutions you need that are best for your situation.

- ATV insurance can contain variations of liability, collision, and comprehensive add-ons to cater to your unique needs, and your premiums will reflect what add-ons you choose.

- Motorcycle insurance has many variables that affect the total price of your premium. You can tailor your plan to reflect how often you ride your bike, but your age, the year of your motorcycle, mileage total, and even the location of where the bike is stored will influence how much you’ll owe each month.

- Recreational Vehicle insurance is sometimes included in standard policies for an automobile, but it’s smart to get separate coverage for your RV before any extended trips since there will be more opportunities for something to happen that may require filing a claim with your insurer.

Why Should I Buy Uninsured Motorist Coverage in Douglasville?

Purchasing uninsured motorist insurance is as essential as grits at a Southern breakfast because it serves as your safety net in the event of a collision with a driver who doesn’t have adequate insurance.

You might be surprised at how many people don’t carry active auto policies in Douglas, and uninsured motorist coverage will help pay for your medical bills and vehicle repairs if you’re in a scrape with someone who can’t pony up for the damages.

In other words, don’t go riding off into the sunset without an uninsured motorist policy because you’ll thank your lucky stars if the worst comes to pass.

Low-Cost Car Insurance by Zip Code in Douglasville

When you’re buying auto insurance, pricing is based on a variety of factors, like your zip code. Douglasville has a relatively slower pace of life than other parts of the Peach State, so there aren’t as many folks on the road, and your premiums will be less than the average Georgian.

*We use the following methodology to arrive at our average cost: male, age 30, state minimum liability and full coverage of 100/300/100

Car Insurance Laws in Douglasville, GA

Georgia outlines what the requirements for state-minimum auto insurance are in the state, including Douglasville. In the Peach State, your basic auto liability terms must include:

- Coverage for bodily injury and death liability per person involved and per accident, with at least $25,000 per person and $50,000 per accident.

- Coverage for property damage liability, with at least $25,000 per incident.

Penalties for Driving Without Auto Insurance Coverage in Douglasville, GA

Bless your heart if you are pulled over and don’t have mandatory liability insurance because you should never drive without insurance, and here’s why: Georgia requires you always have active auto protection, so if you are caught without it, you might face some of the following penalties if it’s your first offense:

- A $200 fine

- Losing your license for 60 days and paying a registration reinstatement fee of $60

If you have subsequent offenses, here are some additional penalties you can encounter:

- Fines up to $1,000 and/or up to 12 months in jail

- License suspension for 90 days or more

- A registration reinstatement fee of up to $160

If you lapse in your policy at any point, you’ll have to pay a fee of $25. As you can see, it’s best to have continuous auto insurance with a reliable provider so you don’t have to worry about these kinds of dilemmas.

Is Additional Medical Coverage a Good Idea in Douglasville?

Adding supplementary medical coverage as a resident of Douglas is like having a sturdy pair of boots when you’re trudging through the Georgia mud – you sure don’t want to be caught without them. One of the most common ways Georgians get additional medical protection is through Medical Payments Coverage, or MedPay.

Medpay is an optional add-on to your auto insurance policy that helps pay for medical expenses resulting from a car accident, regardless of who was at fault. It has the flexibility to extend to you and your passengers money for medical bills, ambulance fees, and other healthcare costs that may arise from a collision, up to the maximum limits.

While MedPay can offer valuable peace of mind should something unplanned happen, whether it’s a good idea ultimately depends on your individual circumstances, like if you already have a healthcare plan and the type of coverage that’s included.

List of Insurance Products Available in Douglasville, Georgia

In addition to auto coverage, there are other insurance solutions, including the three kinds below that are offered in Douglas.

- Landlord insurance protects you financially from unforeseen circumstances as a result of harm from a tenant or other non-human-made disasters like hurricanes or floods, which can be financially devastating. It’s not expensive and most owners pass on the minimal cost to their tenants.

- Mobile home insurance has some of the same features as homeowners insurance, like protecting the structure of the mobile home, and liability coverage for any legal claims in case someone gets injured on your property.

- Commercial auto insurance is ideal if you need to insure your company vehicles. These policies have similar benefits to personal auto insurance but differ in some technical ways such as eligibility, exclusions, coverage, and limits.

What is the Difference Between Renters and Home Insurance?

When it comes to understanding the distinction between renters and home insurance, it’s akin to comparing a country hoedown to a refined ballroom dance. Even if you don’t own much, there are reasons why you still need renters insurance. In fact, buying renters insurance if you lease your living space safeguards your belongings, like furniture, electronics, and clothing, in case of theft, fire, or water damage.

Homeowners insurance is best tailored when you own your home and helps pay for the expenses if something unexpected happens and harms your personal belongings or the physical structure of the home itself. You are safeguarded from a broader range of risks, including natural disasters, liability claims, and additional structures on the property, such as detached garages or sheds.

Both policies are invaluable, whether you’re kickin’ back on the front porch with sweet tea or hosting a backyard barbecue with friends and family. If you are renting or owning, these policies ensure that you can weather life’s twists and turns with confidence (and Southern hospitality, of course).

What are the Best Car Insurance Discounts in Douglasville, GA?

If you’re looking for tips to get affordable rates on your car insurance, here are some auto discounts that are popular in Douglasville:

Get a Quote for Car Insurance Coverage in Douglasville Today!

Douglasville locals must have auto coverage that meets the minimum liability mandate in Georgia. Here at Velox Insurance, we have the customer service and hospitality you expect, and we’ll help you choose the policies you need with affordable pricing. Get started with a quote , come see us at an office near you , or call us at 855-468-3569to speak with an agent.