Cheap Car Insurance in Thomaston, GA

If you’ve ever had to shop for insurance, you know finding a quality plan that’s still affordable can feel like going on a wild goose chase. We specialize in helping all kinds of drivers get great deals so you can skip the stress and get straight to saving money, even if you have a DUI on your record!

Everything You Need to Know About Affordable Auto Insurance in Georgia

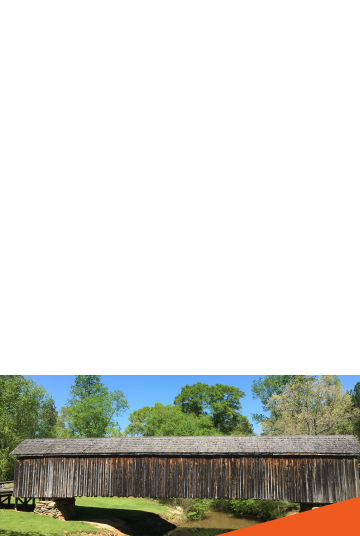

Thomaston is a charming inlet nestled between the bustling cities of Atlanta and Columbus. When driving around Thomaston, you’ll find everything there is to love about small-town living, from historic sites like the Frances Walker house to picturesque spots like the Auchumpkee Creek Covered Bridge. There’s everything you need for a relaxing afternoon off or a laid-back weekend driving around town.

Before you start exploring the city, you need the right auto coverage. Luckily, you can start saving money right away by using a few tricks to get the cheapest car insurance available. Read on to learn everything you need to know about average costs, common penalties, and popular discounts to help you save.

How Much Does Car Insurance Cost in Thomaston, GA?

Thomaston locals pay about $46 per month for minimum liability insurance, which is $22 less than the average payment in Georgia of $68 per month and $16 less than the national average of $62 per month.

Full coverage plans in Thomaston average $147 per month, which is $71 less than the state average of $218 per month. This monthly premium is also $68 less than the nation’s average, which is $215.

Ready to Get a Quick Quote?

Different Vehicle Options for Insurance in Thomaston, GA

There’s more than one way to get around town if you live in Thomaston. Along with your practical pickup or steady sedan, you might have a few other vehicles you like to take for a spin. Here are some of the policies to consider if you have multiple vehicles in your garage:

- ATV insurance: All-terrain vehicles can take you deep into the backwoods, but you’ll want a plan that will stick by you all the way ATV protection will help you pay for anything from scratches and dings to damage from the weather while you’re out adventuring.

- Recreational vehicle insurance: There’s no better way to spend a Georgia summer than packing the family into your RV and hitting the dusty But because an RV is like a home and car all in one, it needs a hybrid policy for full protection. RV protection goes the extra mile to protect every element of your RV if you get into an accident.

- Boat insurance: Whether you have a pontoon or a sailing boat, you’ll need a coverage policy before you’re truly Boat insurance will help you keep your vessel in ship shape, whether you get into a collision on the water or are dealing with weather-related damage.

What Exactly Is Liability Insurance in Thomaston?

If you live in Georgia, you may have heard that you need liability coverage. But what does that mean? A liability plan is the bare minimum you’ll need before you can get behind the wheel. Essentially, it protects other drivers if you cause an accident, so no one else has to pay for any mistakes you might make on the road.

For example, if you’re at fault in an accident, you’re responsible for the other person’s medical bills, car repairs, and more. Luckily, your liability plan will swoop in and help to handle those expenses. However, it won’t pay for your own costs related to your accident. If you want that level of protection, you’ll need to upgrade to a full coverage plan.

Low-Cost Car Insurance by Zip Code in Thomaston

You may already know that insurers consider a wide range of factors when calculating your premium, from your age to your driving history. But did you know they also pay attention to where you live? Some areas have higher costs of living, which often means higher repair costs and claim payouts. Others have higher rates of crime and car accidents, which can also drive up your risk as a driver. If you’re looking for the best rate, keep a close eye on the average premiums in your zip code to make sure you’re getting a good deal.

*We use the following methodology to arrive at our average cost: male, age 30, state minimum liability, and full coverage of 100/300/100.

Car Insurance Laws in Thomaston, GA

The state of Georgia requires all drivers, including those in Thomaston, to have a basic level of liability auto insurance. Here are the minimum coverage limits you’ll need:

- At least $25,000 in bodily injury coverage per person and $50,000 per accident

- At least $25,000 in property damage

Penalties for Driving Without Auto Insurance Coverage in Thomaston, GA

When you drive without a policy in place, you aren’t just risking your financial stability. You’re also putting yourself in the path of potential legal consequences. If you want to avoid extra trouble with the police, make sure you’re aware of the possible penalties for driving while uninsured:

- Fines from $200 to $1,000

- Loss of your driver’s license for 60 to 90 days

- A $25 fee for a lapsed policy

- A suspended registration

- Potential misdemeanor charges

Finding Cheap Car Insurance for Teens in Thomaston

Every parent knows that raising a teen can be expensive. But once they get to driving age, costs can completely skyrocket. Let’s face it: teenagers don’t always think things through, which can make them risky drivers in the eyes of insurers. However, before you stress out over your teen driver’s premium costs, there are a few ways to keep their premium within your budget.

Start by seeing if your insurer offers any special deals for students who earn good grades. If your kid is responsible in school, chances are they’ll be more responsible behind the wheel, helping them secure a lower premium. You can also plan ahead by making sure your child will be driving a car that’s cheap to insure, such as a gently used car with low repair costs and plenty of safety features.

List of Insurance Products Available in Thomaston, Georgia

If you’ve built a life in Thomaston, you deserve to have coverage that protects everything near and dear to your heart. That involves getting coverage for your home, business, and beyond. Here are just a few of the policies to keep in mind:

- Mobile home insurance is a specialty plan designed to protect your mobile home from top to bottom.

- Homeowners insurance is critical for protecting your residence from natural disasters, accidents, and beyond.

- General liability insurance is a must-have for business owners because it limits your financial responsibility if you injure someone or damage their property during the course of business.

What Is the Difference Between Renters and Home Insurance In Thomaston?

Whether you rent or own, home is where the heart is. And it’s up to you to sign up for coverage to protect the things you care about most. So which plan do you need, and what’s the difference between a renters policy and a homeowners policy?

When you rent, you’re mostly concerned with the belongings you keep inside your home. If there’s a fire and your furniture is damaged, you’ll want a policy that will help you replace your furnishings. Renters insurance is designed to cover your belongings in the event of a disaster, break-in, or other unexpected event. It may even help you pay for alternative housing if you can’t live in your rental during repairs.

However, if you’re a homeowner, you’re concerned about much more than just your personal items. You also have an investment in the structure of your home. With a homeowners policy, you can file a claim to repair your roof, fence, and more. Your policy even limits your legal liability if someone gets hurt while on your property.

What Are the Best Car Insurance Discounts in Thomaston, GA?

When you want to get lower rates on your car insurance, you can do more than simply stay safe on the road. Here are a few common discounts that can help you get an even better deal:

Get a Quote for Car Insurance Coverage in Thomaston Today!

Drivers in Thomaston need to have a policy to legally drive in Georgia. At Velox Insurance, we can connect you with great coverage at the best price. Get started with a quote online, visit us at an office near you, or call us at 855-468-3569 for a quote.