Cheap Car Insurance in Savannah, GA

Finding an auto insurance plan that fits in with your budget is no walk in the park, but we’re here to walk you through the whole process. We’re known for helping all drivers get coverage, even with a history of DUI and other challenges, so getting covered will be easy as pie.

Everything You Need to Know About Affordable Auto Insurance in Georgia

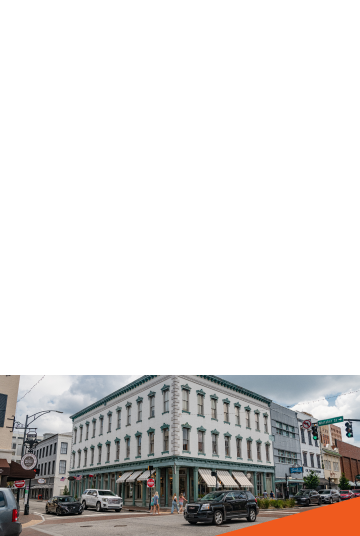

Savannah is one of the great cultural centers of the South, home to everything from stunning coastal vistas to jaw-dropping historic architecture. A day in Savannah could include anything from visiting Old Fort Jackson to lounging at Forsyth Park to snapping pics of the Cathedral Basilica of St. John the Baptist. To finish off the day, grab a classic down-home meal at the iconic Olde Pink House.

There are tons of places to go in Savannah, which means you’ll be pushing your car to the limit every time you hit the city. It’s a good idea to start saving money by doing your research on the cheapest car insurance available. Read on to learn everything you need to know about getting a budget-friendly plan.

How Much Does Car Insurance Cost in Savannah, GA?

People in Savannah pay approximately $53 per month for state-mandated minimum liability coverage, which is $15 less than the typical payment in Georgia of $68. This monthly amount is also $9 less than the United States average of $62.

Full coverage in Savannah is around $152 per month, which is $66 less than Georgia’s average of $218 and $63 less than the nation’s average of $215.

Ready to Get a Quick Quote?

Different Vehicle Options for Insurance in Savannah, GA

Cars and trucks aren’t the only vehicles that are worthy of protection. You want to make sure you’re covered all the time, whether you’re out at sea or rolling along muddy trails. Here are a few options to consider if you live in Savannah:

- Boat insurance Savannah — Heading out for a day on the lake is a great Southern pastime, but nothing can spoil a day out like getting into an accident or noticing damage on your boat. Luckily, that’s why you need your policy. You can get boat coverage to ensure it’s happy sailing wherever you go.

- ATV insurance Savannah, Georgia — ATVs are known for being rough and rowdy, so it’s extra important to get a policy to safeguard your ride. Your ATV plan can cover anything from major crashes to minor accidents so you can ride with confidence.

- Motorcycle insurance Savannah, Georgia — There are motorcycles of all shapes and sizes, from sporty racers to sturdy cruisers, and you can choose from a variety of policies to match. From full coverage to comprehensive to liability, you can insure your motorcycle to your specifications.

What Exactly Is Liability Insurance in Savannah?

During the shopping process, you’ll hear all sorts of technical terms thrown around, starting with “liability.” Liability coverage is a plan designed to limit your financial responsibility if you get into an accident — that’s it. If you cause an accident that hurts someone or damages their property, your insurer will step in to foot the bill. However, that’s where the buck stops. If you have your own repairs or medical bills, you’ll have to handle those on your own.

Liability coverage is legally required everywhere in Georgia, so it’s important to make sure you get a liability plan right away when you start driving. If you have an older car and aren’t concerned about your other costs, it can be a great starting point. But remember, you can always upgrade to give yourself extra peace of mind.

Low-Cost Car Insurance by Zip Code in Savannah

Researching premium costs can have you feeling like a chicken with its head off. Why are prices so different from place to place? Ultimately, it comes down to risk. Insurers look at the history of claims in your area, along with details like population, crime, and car accident rates. They’ll blend all this information with your personal history to calculate a custom premium that takes all those details into account.

*We use the following methodology to arrive at our average cost: male, age 30, state minimum liability, and full coverage of 100/300/100.

Car Insurance Laws in Savannah, GA

As a Savannah driver, you need to make sure your coverage meets the minimum requirements in Georgia. Your basic plan needs to cover:

- $25,000 per person and $50,000 per accident in bodily injury and death liability

- $25,000 per incident in property damage liability

Penalties for Driving Without Auto Insurance Coverage in Savannah, GA

Car insurance isn’t just nice to have as a Georgia driver — it’s required by law. If you want to avoid getting in extra trouble when you see those red and blue lights in the rearview mirror, you need to make sure your policy is active. Otherwise, you could be facing penalties like:

- Fines from $200 to $1,000

- Loss of your driver’s license for up to 3 months

- A $25 fee for a recently lapsed policy

- A suspended registration

- Misdemeanor charges

What Is Joshua’s Law and How Does It Affect My Teen in Savannah?

If you have a teen driver, you’ve likely heard of Joshua’s Law. If you haven’t, it’s time to buckle up because every teen driver in GA needs to know about Joshua’s Law. Georgia didn’t always have strict requirements for teen drivers. Back in 2005, a teen driver named Joshua tragically passed away after getting into a car accident while he was still learning how to drive. As a result, Joshua’s Law was passed in his honor to help steer teen drivers in the right direction with some extra guidance.

Essentially, Joshua’s Law made driver’s education mandatory for underage drivers, along with spending a certain number of hours being supervised on the road by a qualified adult driver. Teens will also have to follow driving curfews to keep the roads safer at night when it can be harder to see the conditions around you.

List of Insurance Products Available in Savannah, Georgia?

Once you have your car taken care of, you may think your coverage needs have ended. But hold your horses — there are plenty of other reasons you might want protection. Whether you own a business or want to make sure your belongings are secure, different insurance products can give you the peace of mind and financial support you deserve. Check out options like:

- Homeowners insurance is designed to protect the structure of your home, the belongings you keep in your home, and other structures like sheds and fences on your property.

- Builder’s risk insurance is for people who are building or renovating their own homes. It will help cover your losses if there’s a major issue with the construction project.

- Commercial auto insurance gives you additional auto protection if you get into an accident in your work vehicle.

How Can I Protect My Business in Savannah?

Being an entrepreneur is a major accomplishment, but when you start a business, you also take on heaps of extra liability. You can always find yourself in a situation where someone claims they’ve been wronged by your business and decides to sue. But that doesn’t mean you have to take on all that risk by yourself. With the right insurance plan, you can protect both yourself and your business.

When you start a business, looking into general and professional liability insurance should be one of your very first steps. General liability will protect you from any physical damage your company causes — imagine if you accidentally injure someone or damage their property while working as a handyman. Professional liability will give you an extra boost of legal protection against financial damages. If someone believes you made a mistake in your work that led to financial damages, then your professional coverage would come into play.

One more thing — don’t forget about your company vehicle. If you drive a car as part of your business, even if it’s just to get to and from your work sites, you should think about commercial auto insurance to protect your car.

What Are the Best Car Insurance Discounts in Savannah, GA?

By looking for a few extra discounts, you can save a bushel and a peck on your auto insurance. If you want to get lower rates, you can get started by asking about insurance savings programs like:

Get a Quote for Car Insurance Coverage in Savannah Today!

Savannah residents need to have insurance that meets minimum liability requirements before they can hit the road in Georgia. Velox Insurance provides you with the coverage you need at a price that’s easy on your wallet. Get started with a quote online, visit us at an office near you, or call us at 855-468-3569 for a quote.