Cheap Car Insurance in Roswell, GA

If your driving record isn’t exactly picture-perfect, finding affordable insurance can be tougher than a two-dollar steak. But you don’t have to worry. We specialize in setting all drivers up for success with auto coverage that is good as gold — including people with DUIs and other imperfect records.

Everything You Need to Know About Affordable Auto Insurance in Georgia

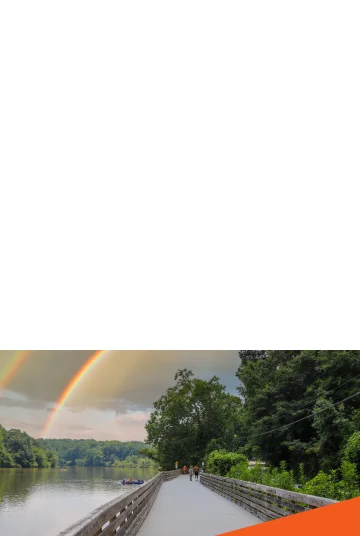

Roswell is a happening area not far from Atlanta, giving you a mix of parks, historic sites, and exciting venues. You can zipline along the Chattahoochee River, visit museums like Bulloch Hall, or explore trendy breweries.

To get around Roswell, you need a reliable car or truck and dependable coverage to boot. If you care about saving money while still protecting your vehicle, it’s important to research your insurance coverage options. You can get started by reading below about the ins and outs of policies in Roswell.

How Much Does Car Insurance Cost in Roswell, GA?

People in Roswell pay about $55 per month for state minimum liability policies, which is $13 less than the state average of $68. This monthly amount is $7 less than the national average of $62.

In Roswell, full coverage is about $141 per month, which is $77 less than the Georgia average of $218 and $74 less than the United States average of $215.

Ready to Get a Quick Quote?

Different Vehicle Options for Insurance in Roswell, GA

Even if you love your trusty car or truck, sometimes you need to have a bit of off-road fun with a different type of vehicle. Here are some of the options you should explore for the various vehicles that power your life in Roswell:

- ATV insurance Roswell, Georgia – Everyone knows that all-terrain vehicles can give you the thrill of your life. But your high-adrenaline adventures will be much more fun when you know your ATV has the right coverage. Plans can include anything from liability to full coverage and comprehensive options to protect your ATV from fire, hail, and vandalism.

- Motorcycle insurance Roswell, Georgia – When you drive your motorcycle down dusty back roads, you need a policy to protect you from collisions, natural disasters, and other unexpected events. Just like car coverage, a motorcycle policy can vary from minimum liability to full coverage that will protect your bike in any situation.

- Recreational vehicle insurance Roswell – Sometimes, you just want to get away from the hustle and bustle of your daily life by taking a trip in your RV. Since RVs are a combination of a vehicle and a living space, they need a special blend of coverage. Getting a specialized RV plan will ensure you have the protection you need.

Why Is Insurance So Cheap in Roswell?

Insurance in Roswell is much cheaper than in many other parts of Georgia. While there are several factors that can go into average premium costs, the low property crime rates in Roswell could be a strong contributing factor. Because there’s so little property crime in the area, it’s less likely you’ll have to make a claim due to vandalism or theft.

Premiums are also usually cheaper in suburban areas compared to big cities. While Roswell is a pretty large suburb, it’s still much less dense than Atlanta, earning a relatively low coverage rate. Lower crime, fewer accidents, and higher rates of home ownership can all contribute to lower average premiums.

Low-Cost Car Insurance by Zip Code in Roswell

Insurers calculate your premiums based on tons of moving pieces, including your driving history, the type of vehicle you drive, and, of course, where you live. Different zip codes have different risk levels due to factors like population size, crime, and average claim payouts.

*We use the following methodology to arrive at our average cost: male, age 30, state minimum liability and full coverage of 100/300/100

Car Insurance Laws in Roswell, GA

If you live and drive in Roswell, you need to comply with Georgia’s requirements for vehicle policies. In order to legally drive your car, you need to have a minimum liability plan that includes these coverages:

- Bodily injury coverage for $25,000 per person and $50,000 per accident

- Property damage coverage for $25,000.

Penalties for Driving Without Auto Insurance Coverage in Roswell, GA

Your car coverage doesn’t just protect you financially. It also ensures you don’t get into legal trouble because of your policy status. If you get caught driving without a policy in Georgia, you can expect penalties like:

- A suspended license

- A suspended registration

- Fines from $200 to $1,000

- A $25 fee if your policy lapsed in the last 10 days

- Potential misdemeanor charges

Finding Cheap Car Insurance for Teens in Roswell

Every teenager is excited for the day they start driving. But for each excited teen ready to get on the road, you’ll see a nervous parent who’s wondering how much coverage will cost. Even though coverage for teens can cost a pretty penny, there are steps you can take to keep your premiums down.

Is your teen a smart cookie who makes good grades in school? That could qualify you for serious savings. By showing that they’re responsible in school, your teen can decrease their risk level in the eyes of insurers, giving you a helpful discount. You can also save by choosing an affordable car with safety features to lower their risk level even more.

List of Insurance Products Available in Roswell, Georgia?

Insurance is all about protecting the things you value most, which includes more than just your car or truck. Here are some other options to explore:

- Renters coverage allows you to make a claim if your belongings are damaged, stolen, or vandalized while you live in a rental.

- Commercial auto insurance protects you behind the wheel if you use your car for your business.

- Builder’s risk insurance safeguards your investment if you’re building a new property, so you can make a claim if something disrupts the construction process.

Do I Need Landlord Insurance if I Rent a Room Out?

Renting out a room in your home can be a great way to help you afford your mortgage, save up extra money, and make passive income. However, being a landlord is a lot of responsibility. Along with your standard obligations as a landlord, you’re also taking on some risk by inviting a tenant into your home. So, should you get landlord coverage?

Even if you’re only renting out a single room in your home, you should still protect yourself with a landlord policy. Your plan will help reimburse you for property damage, whether a storm damages the rental area or your tenant causes more than just standard wear and tear. Some policies can also cover any loss of rental income if an unexpected situation disrupts your lease.

What Are the Best Car Insurance Discounts in Roswell, GA?

Everyone loves a great deal. That’s why there are multiple discount programs you can use to get lower monthly car rates on your policy. When you sign up, ask your agent if you qualify for deals like:

Get a Quote for Car Insurance Coverage in Roswell Today!

All Roswell motorists need coverage that meets Georgia’s minimum liability laws. Velox Insurance can set you up with the right plan at the right price. Get started with a quote , visit us at an office near you, or call us at 855-468-3569 for a quote.