Comprehensive Vs Collision Auto Insurance: Everything You Need to Know

Even the safest drivers can be involved in a collision from time to time, and the expenses related to an auto accident or another loss event can be staggering. Nonetheless, many drivers wonder if paying a car insurance premium each month is worthwhile. The bottom line is that car insurance is essential for all drivers, but actual coverage needs vary from driver to driver based on several factors.

What Are Comprehensive and Collision Auto Insurance?

There are three primary types of auto insurance, and these are liability, collision, and comprehensive. In most states, drivers must purchase a minimum level of liability insurance. Some states have additional minimum coverage requirements, such as for uninsured motorist coverage, personal injury insurance, or others. Collision and comprehensive insurance are not required by law, but an auto lender could require you to keep your vehicle insured with these types of coverage until your loan is paid off. Being over-insured and underinsured can both be costly, so understanding the differences between collision and comprehensive insurance will help you to set up a car insurance policy that is a great fit for your unique needs.

Comprehensive Auto Insurance

Comprehensive car insurance is often purchased in addition to liability and collision coverage because they cover different types of expenses and events. However, it is not necessarily beneficial to some drivers. A closer look will help you to decide if your policy should include comprehensive insurance.

What Is Comprehensive Auto Insurance?

As the name implies, comprehensive insurance provides benefits for a wide range of events. The liability insurance required by most states provides benefits to other parties who may incur expenses related to your actions on the road. For example, liability insurance may pay for repair expenses to another driver’s vehicle if you are deemed to be the at-fault party. This coverage will not pay for any of your own expenses. Comprehensive auto insurance, on the other hand, provides benefits related to covered events.

Comprehensive Insurance Coverage

Comprehensive auto insurance pays benefits for a wide range of covered events. This includes vehicle repair or replacement expenses related to bad weather, fire, criminal activity and more. Damages related to many of these events are not covered under any other type of auto insurance coverage available. Without comprehensive insurance on your policy, you would be fully responsible for related expenses.

Because your vehicle serves as the collateral for your auto loan, a lender may require you to fully cover the vehicle through this type of policy. If you need to file a claim, the coverage will pay to repair the lender’s collateral or to pay off the remaining balance on the loan in a total loss situation.

The Cost of Comprehensive Car Insurance

Your auto insurance premium will be based on a combination of factors. These include the replacement value of your vehicle, your driving record, your zip code, optional coverage types selected and more. Each auto insurer analyzes these factors differently. Variations in rates and discounts offered by different insurers also affect the insurance premium. Even more, learning to minimize auto insurance is also one of the top ways to save money and protect your budget.

Comprehensive Coverage Limits

The comprehensive insurance coverage limit is directly linked to the vehicle’s value. In most cases, the insurer will not pay more on a claim than the vehicle was worth before the loss event. Paying for more coverage will not yield a financial benefit. Keep in mind that it may not be financially advantageous to purchase comprehensive insurance for a vehicle with a low value and that is not tied to a loan. This is because you may easily pay far more in insurance premiums and the deductible than the vehicle is worth.

What Is a Deductible?

Your auto insurance policy’s deductible can be set by you, but your insurance company may place upper and lower limits on it. A common deductible is $500. This is the amount that you are responsible for when you file a claim. The insurer will pay for all other covered expenses. All other expenses will be your responsibility. By choosing a higher deductible when you set up your policy, the premium will be slightly lower. A lower deductible will result in a somewhat higher premium.

Filing a Comprehensive Auto Insurance Claim

If your vehicle has been vandalized, damaged by hail, impacted by a falling tree branch or affected by any number of other events, you can file a claim against your comprehensive auto insurance policy. If the event is covered, you will pay the deductible amount that you have selected. Additional expenses for the repair or replacement of your vehicle will be covered by the insurer up to the coverage limits. You can purchase additional coverage for personal injury expenses, rental car reimbursement and more.

Collision Auto Insurance

Like comprehensive insurance, collision insurance covers your own expenses for auto repairs or a vehicle replacement. Collision auto insurance is frequently purchased along with comprehensive insurance because they offer different types of protection.

What exactly is collision auto insurance?

Collision coverage provides tremendous financial protection under specific circumstances. However, it is not cost-effective for all drivers. If your vehicle is owned outright and coverage is not mandated by an auto lender’s requirement, you can weigh the benefits of collision coverage to determine if it is right for you.

What Does Collision Insurance Cover?

Comprehensive insurance covers most types of damaging events, but it does not cover collisions. If your vehicle collides with another car, a building, a tree or something else, your expenses would be covered by your collision auto insurance policy up to the policy’s limits. The exception is if your car collides with an animal, such as a deer. This is the only type of collision that would be covered under a comprehensive insurance policy.

How Much Is Collision Coverage?

The same factors that affect the cost of comprehensive insurance are relevant to collision coverage. To determine the cost of collision insurance on your vehicle, you will need to request a quote. Insurance providers may adjust their rates periodically. In addition, the vehicle’s value and other factors that impact the cost of insurance will change over time. It is important to reassess your coverage periodically to ensure that your policy is adequate for your needs.

Collision Coverage Limits

Collision coverage limits are comparable to comprehensive coverage limits. The payout that you receive on a claim will generally not exceed the actual value of the vehicle. This will be reduced by the amount of the deductible. Purchasing a collision policy with coverage that exceeds the vehicle’s value will not yield benefits.

The Deductible for Collision Coverage

When you file a claim, you will pay a single deductible for the entire event. For example, if you are liable for another party’s expenses and if your vehicle is damaged in a collision at the same time, you will only pay the deductible once for both liability and collision benefits. Therefore, the deductible that you select when you set up your policy will apply to all covered expenses under a single claim.

Filing a Collision Auto Insurance Claim

Collision auto insurance will protect you from experiencing potentially tremendous financial loss in the event of a collision accident. Many repair bills are thousands or tens of thousands of dollars. Without coverage, you would be responsible for these expenses out of your own pocket. Even safe drivers with few or no blemishes on their driving record can have a mishap on the road, so collision coverage should be considered unless your vehicle has nominal value.

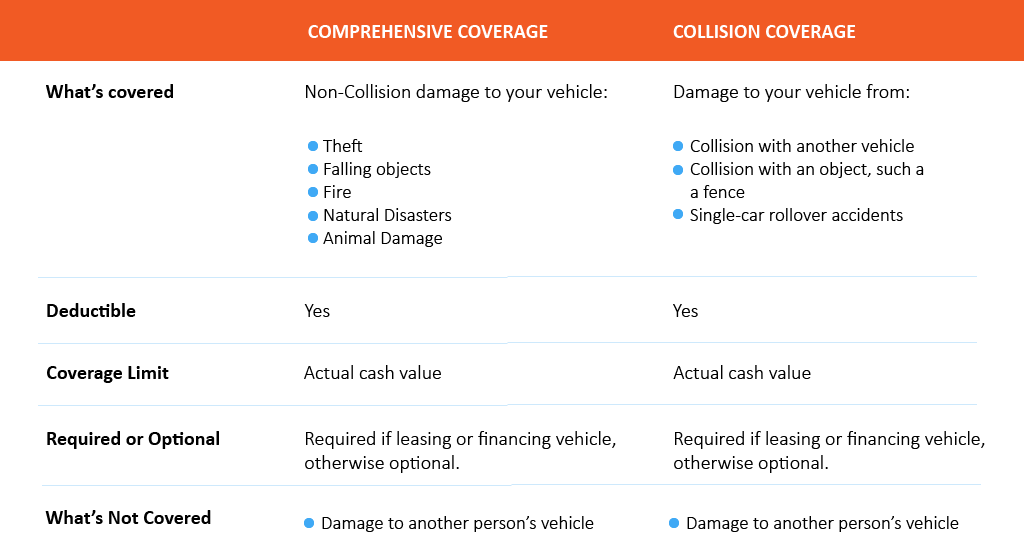

Differences Between Comprehensive and Collision Auto Insurance

Comprehensive and collision auto coverage both payout on claims for your own vehicle. However, they cover expenses related to different events. Collision insurance provides benefits for most vehicular collision events, and the primary exception is a collision with wildlife.

Comprehensive and collision insurance can be important parts of an auto insurance policy. Understanding the difference is important when choosing car insurance.

Most other types of vehicle damages may be covered under comprehensive insurance. Find out whether comprehensive insurance or collision insurance is right for you. Please refer to the table below.

Final Thought

Whether your vehicle is damaged in a collision, by bad weather or by any number of other events, the cost of repairs or a vehicle replacement can be tremendous. Comprehensive and collision coverage complement each other because they protect you against different types of losses, so they provide essential benefits for many drivers. If your auto loan is paid off and if the car’s value is minimal, however, you may feel comfortable simply buying the minimum liability coverage required by law.